Learning how to use Cash App is straightforward, and using it can make sending payments quick and convenient.

Updated Feb 15, 2024 · 3 min read Written by Ruth Sarreal Content Management Specialist Ruth Sarreal

Content Management Specialist | Bank accounts, bank account bonuses

Ruth Sarreal is a content management specialist covering consumer banking topics at NerdWallet. She has over a decade of experience writing and editing for consumer websites. She previously edited content on personal finance topics at GOBankingRates. Her work has been featured by Nasdaq, MSN, TheStreet and Yahoo Finance.

Assigning Editor Yuliya Goldshteyn

Assigning Editor | Banking

Yuliya Goldshteyn is a former banking editor at NerdWallet. She previously worked as an editor, a writer and a research analyst in industries ranging from health care to market research. She earned a bachelor's degree in history from the University of California, Berkeley and a master's degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. She is based in Portland, Oregon.

Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

MORE LIKE THIS Payments and Money Transfers BankingTable of Contents

MORE LIKE THIS Payments and Money Transfers BankingThe investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

As more people embrace the convenience of cashlessness and contactless payment, tech companies have made it easier to send and receive money instantaneously from a smartphone. Cash App, one of these services, offers some unique functions compared with other money transfer options, including options for savings and investing.

Read on to learn more about Cash App and its features, benefits and possible drawbacks.

Cash App is a peer-to-peer money transfer service that allows users to send and receive money. Cash App can help you send your share of utilities to your roommates, pay friends back for coffee, split the cost of a trip or any other money-sending task you want to accomplish with other Cash App users.

Cash App has branched out from just money transfers. It now also offers:

The ability for users ages 13 and up to invest money in stocks through Cash App Investing. The option to buy and sell Bitcoin. Free tax filing with Cash App Taxes. A savings feature — Cash App Savings.Note that Cash App is a financial services platform from Block Inc., not a bank.

Cash App works on your smartphone (though you can do some functions through a web browser). To use Cash app, you need to sign up for an account. You can do that through a browser or by downloading the app to your smartphone. Once you have an account, connect a funding source (such as a bank account or debit card) and you’re ready to send and receive money with people you know and trust, and explore the app’s other services.

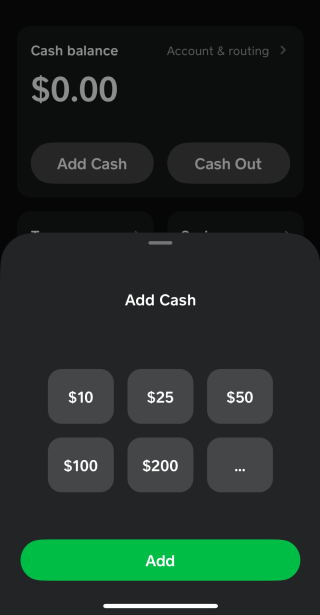

To use Cash App to send payments, you need a bank account, debit card, credit card or prepaid card. You load money on Cash App by tapping the Money tab in the app’s home screen, tapping “Add Cash” and inputting how much cash you’d like to add from your linked account.

You’ll then need to confirm the transaction by entering your PIN for the app or by using a biometric ID.

You’ll be able to use your linked bank account, debit card or other funding source to send money to other Cash App users, as well as to transfer money from your Cash App account into your bank account. This function is similar to services like Venmo and PayPal , which also allow you to link a bank account to send money; you can also hold any received funds in the app until you’re ready to withdraw them.

You should send money only to people you know and trust. Before using money transfer apps, learn other tips to avoid P2P scams .

To view the details of a received payment, tap the “Activity” button. You’ll also see the total amount of your Cash App balance at the bottom left of the app home screen.

You can also fill out a form to get your paycheck directly deposited into your Cash App account and deposit physical cash into your account at participating retailers for a fee.

If you have the Cash App debit card, you can use it to make withdrawals at an ATM. Withdrawals are free at in-network ATMs and $2.50 each (plus ATM operator fees) at out-of-network machines. You can earn one instant out-of-network ATM fee reimbursement every 31 days by having paycheck direct deposits totaling at least $300 in the calendar month.

You can also cash out your app balance and have the funds transferred to a bank or debit card linked to your Cash App account.

Optional free debit card . The “Cash App Card” allows users to make transactions. The card is issued by Sutton Bank and is unique to a user’s Cash App account. It isn’t connected to a personal bank account or another debit card.

Free ATM withdrawals with direct deposit. If you set up your account to receive direct deposits, ATM withdrawals won’t cost you a fee. Otherwise the fee is $2.50 to use an ATM to make a withdrawal with a Cash App Card. (Note: You can’t deposit cash at an ATM with your Cash App Card; cash deposits can only be made at participating retailers.)

Money-saving offers when using the debit card. Users who have the Cash App Card can choose offers in their account that allow them to save money on a purchase with a particular vendor (for example, a certain amount off your total bill at a restaurant). Only one offer is allowed to be active at a time, but you can swap offers as often as you want.

No fees on basic services. Cash App doesn’t charge monthly fees, fees to send or receive money (unless you’re sending from a credit card), inactivity fees or foreign transaction fees.

Fee for using a credit card. Cash App charges 3% of the transaction to send money via a linked credit card. This is a fairly standard fee compared with other money transfer apps; Venmo, for example, also charges 3% to send money with a linked credit card. To avoid this fee altogether, use your linked bank account or the funds in your Cash App account to send money.

Fee for instant deposits of Cash App funds to your bank account. You’ll pay 0.50% to 1.75% of your total transfer to have your funds transferred immediately. There’s no fee to deposit your Cash App funds to your linked account with a standard transfer, which takes one to three business days.

Cash App Card spending limits. The maximum that can be spent on your Cash App Card is $7,000 per transaction and per day and $10,000 per week. The maximum that can be spent per month is $25,000.

Cash App Card withdrawal limits. The maximum amount that can be withdrawn at an ATM or store register cash-back transaction is $1,000 per transaction, $1,000 per day and $1,000 per week.

Cash App age limits. People 13 years and older can use the app. Cash App users 17 and younger must have an adult sponsor their account to use some features.

Cash App Savings. The new Cash App savings feature doesn’t charge a fee. You must have a Cash App Card and an opening deposit of at least $1 (though if you use the roundup feature to open your account, you can open a savings account less). The account offers a competitive interest rate of 4.50% as long as you meet a few other requirements: In addition to having a Cash App Card, you must be at least 18 years old and have at least $300 in direct deposits each month. If the requirements aren’t met, the account earns 1.50%.

Cash bonus when friends join by using your referral code. If you send a referral code to your friends and they sign up for Cash App using your link, then you receive a cash bonus per friend who signs up.

Cash App Investing. Cash App offers the ability to invest. The app allows users to buy stock in specific companies with as little or as much money as they want to invest. Stocks can be purchased with the funds in your Cash App account; if you don’t have enough funds in the app, then the remaining amount will be taken from your linked bank account.

Cash App Taxes. The app offers a free tax-filing service that it guarantees to be completely accurate. If you choose to have your refund deposited to your Cash App account, you could receive your return up to five days faster than you would with a bank account deposit. (Refer to the FDIC insurance information for Cash App funds .)

» Prepping for April 15? See NerdWallet’s guide to how to file taxes

Bitcoin compatible . Cash App users can buy and sell Bitcoin, but Cash App might charge a fee, which you’ll see before you complete the transaction. Depending on how quickly you choose to receive deposits of Bitcoin you withdraw, you may be charged a fee for withdrawals, too.

Your funds aren’t automatically FDIC-insured. You must have a Cash App Card or a sponsored account to get Federal Deposit Insurance Corp. insurance coverage. If you don’t have either of those, the money in your cash app balance is not insured and it’s a good idea to transfer your funds to your FDIC-insured bank.

Fees may apply. Cash App charges 3% of the transaction amount when you send money using a linked credit card, which is similar to what other money transfer apps charge. Immediate transfers to your bank account also cost a fee. (Refer to the Cash App fees information above for more details.)

Frequently asked questions What is Cash App?Cash App is a peer-to-peer money transfer service that lets users send and receive money. Cash App also lets users perform some functions as they would at a bank, giving users the option to have a debit card — called a “Cash App Card” — that allows them to make purchases using the funds in their Cash App account. Cash App Card users can also choose to save money in a high-yield savings subaccount. General Cash App users can also invest their money in stocks and buy and sell Bitcoin with the app.

How does Cash App work?Cash App is a mobile application, so to use it to its full extent, you’ll need to download the app to your mobile phone. You can open an account using a web browser, though, and perform some functions. You'll need to link your account to your bank account or another external funding source. To pay someone or request a payment through Cash App, you must enter the other person’s $Cashtag, email address or phone number after you tap “Pay” or “Request.”

Is Cash App safe?Cash App is safe to use to send and receive money to and from people you know. Information you send on the app is encrypted, and the app uses fraud detection technology.

You can help keep your Cash App use safe by following best practices, including using it to send and receive money to friends and family only. Other precautions you can take include turning on the security feature that requires your passcode, fingerprint or face recognition to make a Cash App payment and enabling email or text notifications so you’re alerted of every Cash App payment. (Learn more about how to avoid peer-to-peer payment app scams .)

Do I need a bank account for Cash App?No, you don’t need to have a bank account to use Cash App. The app also lets you link a debit, credit or prepaid card.

What is Cash App?Cash App is a peer-to-peer money transfer service

that lets users send and receive money. Cash App also lets users perform some functions as they would at a bank, giving users the option to have a debit card — called a “Cash App Card” — that allows them to make purchases using the funds in their Cash App account. Cash App Card users can also choose to save money in a high-yield savings subaccount. General Cash App users can also invest their money in stocks and buy and sell Bitcoin with the app.

How does Cash App work?Cash App is a mobile application, so to use it to its full extent, you’ll need to download the app to your mobile phone. You can open an account using a web browser, though, and perform some functions. You'll need to link your account to your bank account or another external funding source. To pay someone or request a payment through Cash App, you must enter the other person’s $Cashtag, email address or phone number after you tap “Pay” or “Request.”

Is Cash App safe?Cash App is safe to use to send and receive money to and from people you know. Information you send on the app is encrypted, and the app uses fraud detection technology.

You can help keep your Cash App use safe by following best practices, including using it to send and receive money to friends and family only. Other precautions you can take include turning on the security feature that requires your passcode, fingerprint or face recognition to make a Cash App payment and enabling email or text notifications so you’re alerted of every Cash App payment. (Learn more about

how to avoid peer-to-peer payment app scams

Do I need a bank account for Cash App?No, you don’t need to have a bank account to use Cash App. The app also lets you link a debit, credit or prepaid card.

Cash Management Money Market Learn MoreSoFi Checking and Savings

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.50% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 8/27/2024. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

Min. balance for APY Read reviewEverBank Performance℠ Savings

Min. balance for APY Learn MoreBarclays Tiered Savings Account

Min. balance for APYThese cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.

These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.

Learn Moreon Wealthfront's website

Wealthfront Cash Account

Min. balance for APY Learn Moreon Betterment's website

Betterment Cash Reserve – Paid non-client promotion

*Current promotional rate; annual percentage yield (variable) is 5.50% as of 4/2/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .75% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks conducted through clients’ brokerage accounts at Betterment Securities.

Min. balance for APYCDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.

CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.

Learn MoreMarcus by Goldman Sachs High-Yield CD

4.60% APY (annual percentage yield) as of 09/13/2024

Federally insured by NCUA

Alliant Credit Union Certificate

Annual Percentage Yield (APY) is accurate as of 09/13/2024

Checking accounts are used for day-to-day cash deposits and withdrawals. Checking accounts are used for day-to-day cash deposits and withdrawals.

Discover® Cashback Debit

Chase Total Checking®

Deposits are FDIC Insured

Chime Checking Account

Monthly fee Money market accounts pay rates similar to savings accounts and have some checking features. Money market accounts pay rates similar to savings accounts and have some checking features.

Discover® Money Market Account

You’re following Ruth Sarreal

Visit your My NerdWallet Settings page to see all the writers you're following.

Ruth Sarreal is a content management specialist at NerdWallet. She has written and edited content on personal finance topics for more than five years. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105